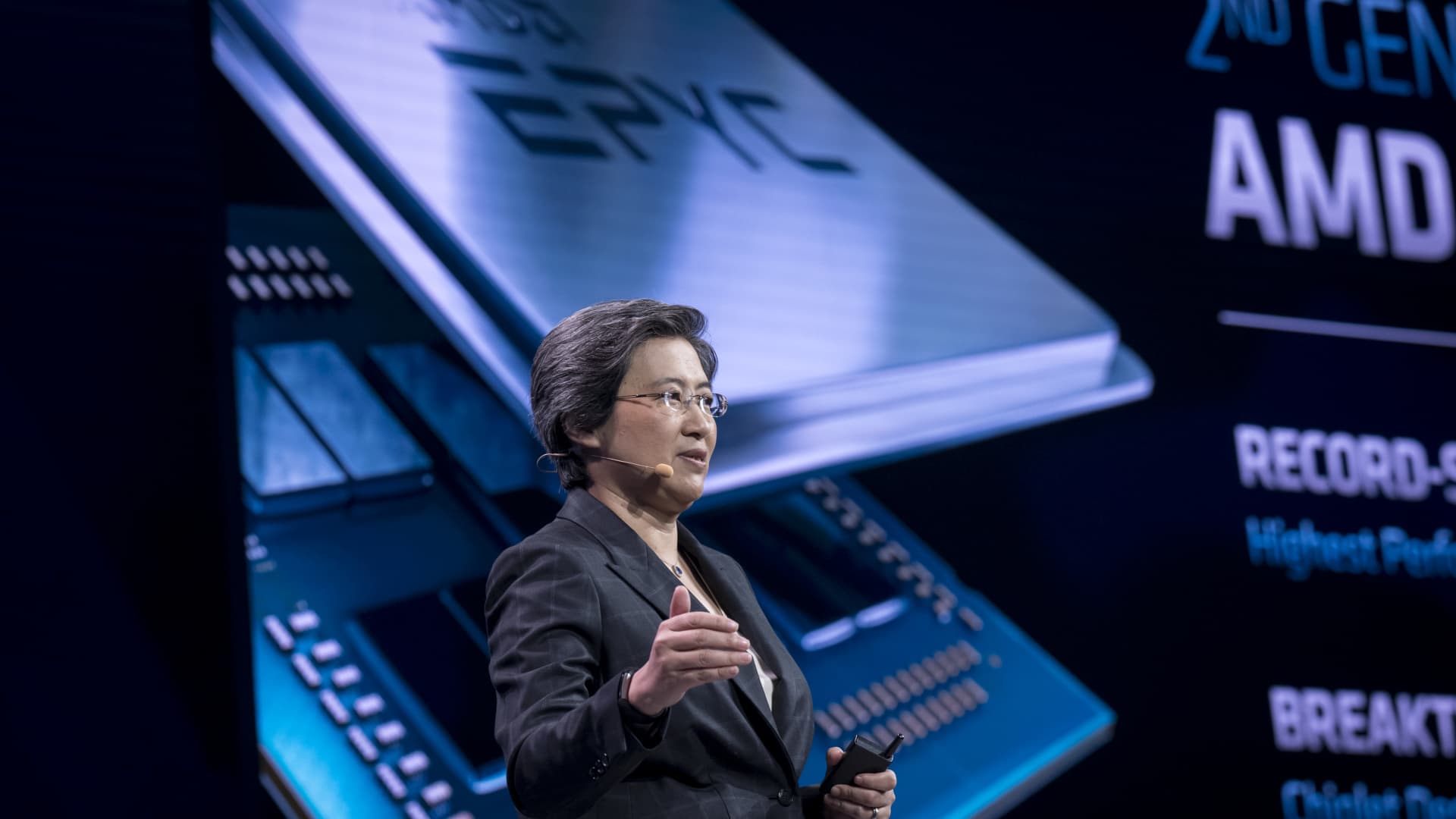

Lisa Su, president and CEO of Advanced Micro Devices, speaks during a launch event in San Francisco on Aug. 7, 2019.

David Paul Morris | Bloomberg | Getty Images

AMD stock spiked more than 8% Wednesday, a day after the company beat top- and bottom-line earnings estimates and gave a promising 2024 forecast for its artificial intelligence chip business.

The chipmaker posted earnings per share of 70 cents, adjusted, narrowly beating the LSEG, formerly Refinitiv, estimate of 68 cents per share. Revenue was also a slim beat, totaling $5.8 billion versus the $5.7 billion expected.

One comment seems to have excited Wall Street: AMD CEO Lisa Su said Tuesday evening that the company expects GPU revenue of about $400 million during the fourth quarter, and to top $2 billion in 2024.

That forecast turned the stock around and helped it rally Wednesday.

Wall Street analysts like AMD’s prospects in the AI market, which is currently dominated by Nvidia. Still, AMD is one of only a handful of companies capable of making high-powered graphics processing units that power AI models.

“Upcoming MI300 accelerator is guided to $400mn sales in Q4E and $2bn+ in CY24E, with healthy traction across hyperscalers, enterprises, OEMs, and AI startups,” Bank of America analysts said in a note to investors. AMD said its new MI300A and MI300X GPUs are on track for volume production during the fourth quarter of this year.

Analysts at Raymond James lowered their price target from $145 to $125 but kept AMD as a “strong buy” largely due to its AI business.

“We are lowering our estimates but continue to like the story due to long term AI/ML potential. AMD is off to a solid start, and we see no reason why the company can’t capture 10–20% share of the $100B+ AI accelerator market longer term,” the Raymond James analysts said.

Analysts at Jeffries echoed the same sentiment toward AMD’s GPU business.

“Perhaps the best news on the earnings call was that AMD now expects its datacenter GPU family (MI300) to ship for $2bn in revenues in 2024 (we believe Street was at $1bn-$1.5bn), starting at $400m in both 4Q23 (HPC) and in 1Q24 (inferencing + training),” wrote Jeffries analysts in an investors’ note.

— CNBC’s Kif Leswing and Michael Bloom contributed to this report.

Don’t miss these stories from CNBC PRO: